This week the most radical social, political, and economic transformation in peacetime US history has crystallized under the mandate of economic stability. It will be the largest socialization of debt and privatization of profit in living memory.

On Monday, the Federal Reserve went “all in” propping up the markets for US treasuries, mortgages, and corporate debt, and offering infinite resources for the purchase of bonds. In this maneuver the Federal Reserve entered uncharted territory, staking up to $300 billion for the acquisition of corporate debt. A few days later on Thursday, the Senate passed a $2 trillion bailout package, with a $500 billion lending program for large corporations.

Mario Draghi, the long-time head of the European Central Bank wrote:

“It is already clear that the answer must involve a significant increase in public debt. The loss of income incurred by the private sector — and any debt raised to fill the gap — must eventually be absorbed, wholly or in part, on to government balance sheets. Much higher public debt levels will become a permanent feature of our economies...” [my bold]

So let’s rewind and review what has happened over the past decade since the ‘08 financial crisis. Central Banks, in a purported urge to boost spending and investment, cut interest rates to near zero making money cheap. Corporations, often using enormous leverage, borrowed money to fund massive share buybacks, pay out large dividends, and fund exorbitant executive bonuses.

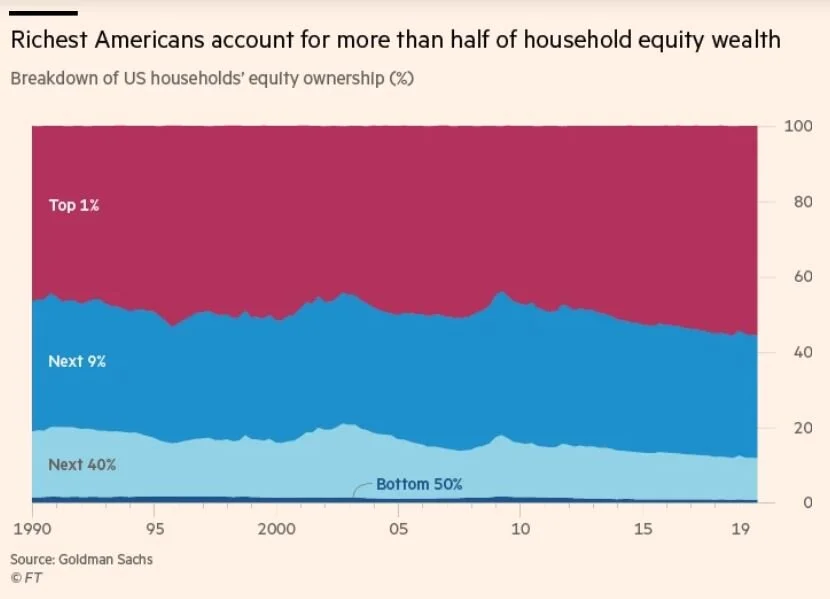

They enriched shareholders. And shareholders are a disproportionately small elite.

In 2019, S&P 500 companies spent more than 100% of their free cash flow on share buybacks and dividend payments. These corporations enriched shareholders through the reckless accumulation of debt. More than half of the share buybacks were funded with debt. A share buyback directly increases a stock’s value by reducing its supply and inflating Earnings Per Share, a key valuation metric.

Corporate debt swelled to almost $10 trillion in late 2019, close to 50% of the US GDP, provoking SEC Chairman, Jay Powell, to make the muted remark that, “Those are numbers that should attract our attention”.

All of that concentration of wealth - much of it used to create unsustainable companies in industries decimating the natural environment, and which have brought us to the brink of biosphere collapse - is now transfigured into a debt that is to be shouldered and swallowed by the public. By regular people, many of whom are not even born yet.

This was done without consultation, with minimal thought, and without any sort of feedback. Bolted into place during a time of fear and terror. This has just happened. To you, to me, to future generations, for decades to come. And on what basis and to what end?

Protection of jobs will be the common refrain, yet in other jurisdictions as soon as these companies have secured their bailouts they have announced mass layoffs of staff.

Preventing a run on the banks who recklessly funded this debt is a clear incentive and perhaps the one with the coldest logic.

But let’s not beat around the bush: the most crystalline aim is the protection of shareholder wealth. We have created a world of vampiric wealth concentrators, whose raison d’etre is pure enrichment, and a political class enfeebled to them.

Dystopia is just getting started.